About

David Nelson, CFA

Chief Strategist Belpointe - Talking Head covering markets, stocks & politics. A career that took me from Rock to Stocks gives me a different perspective.

+ FOLLOW THIS TUMBLRThe Death of OPEC?

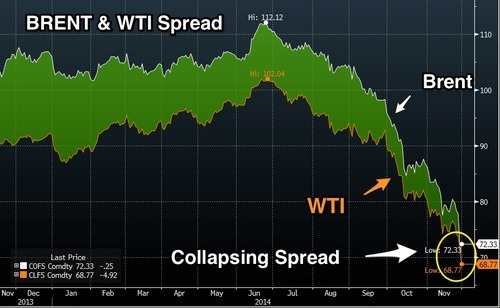

On Thanksgiving Day a perfect storm hit world energy markets following OPEC’s decision to leave current production unchanged at 30 million barrels of oil per day. Both Brent and WTI crude fell more than 6% with WTI breaching the psychological level of 70. There had been speculation members would make a token cut to placate the demands of Venezuela and Iran who desperately need higher prices to meet their own budget needs.

With OPEC unwilling or unable to halt the slide in prices, some are questioning the organization’s ability to survive. Bloomberg reported that Iraqi Oil Minister Adel Abdul Mahdi said they considered a cut of “1.5 million barrels” but even a small 5% reduction couldn’t get done. Despite previous comments and demands members are putting up a united front with many saying they support the decision.

New technologies able to extract oil and natural gas long thought unrecoverable have lifted U.S. energy production to a level where we now produce more than we import. With supply outstripping demand Thursday’s announcement seems to be an admission the once powerful cartel can’t cut production enough to keep prices at their desired target of $100.

With Oil in a Bear Market Why Didn’t They Cut?

We may not know for some time all the reasons behind Thursday’s decision but there have been enough leaks along with recent observations to piece together why no action was taken. The truth is, the needs of the member states vary widely. Saudi Arabia, a low cost producer and de facto leader of OPEC had already decided to defend market share rather than price. Wealthier members have chosen to ride out the storm turning over control to market forces. For weaker countries like Venezuela and Iran the pressure intensifies as their economies struggle to keep afloat.

Outside of OPEC

Oil producing countries outside of OPEC are also feeling the pain. Both Russia and Brazil’s economies are at risk if the slide in price continues. Vladimir Putin’s ambition to return Russia to its former strength is highly dependent on higher oil prices to finance his vision. Recently Nigeria was forced to devalue its currency in response to the falling commodity. The list of casualties is likely to grow especially if oil can’t find a floor somewhere near current levels.

The OPEC Rope-a-Dope

Not everyone believes OPEC’s decision was a sign of weakness. Russian oil tycoon Leonid Fedun VP and board member of OAO Lukoil said; “OPEC policy on crude production will ensure a crash in the U.S. shale industry.” He goes on to say; “In 2016, when OPEC completes this objective of cleaning up the American marginal market, the oil price will start growing again. Did OPEC just do the Rope-a-dope? Leonid seems to think so.

While Mr. Fedun’s comments seem far-fetched I don’t think we should dismiss them entirely. It’s all but certain there will be corporate casualties in the oil patch. Sea drill’s (SDRL) suspension of its dividend and over 66% fall from last year’s high is a warning that others may be forced to make similar decisions.

Geopolitics

For as long as I can remember, geopolitical concerns have provided an endless bid for crude. Earlier this year I joined CNBC’s Street Signs with Brian Sullivan and Amanda Drury to discuss the implications for energy prices on the back of the ISIS incursion into IRAQ. While Brent climbed briefly to 112, the spike was short lived and my call for higher prices was quickly proved wrong. The supply disruption I feared didn’t take place as ISIS wasn’t able to penetrate to the South. Since then, the economic forces discussed above have sent oil on a waterfall decline.

Where do we go from here?

In the long run falling energy prices are a huge benefit however, the speed at which this takes place could cause pain for many caught unprepared. Estimates on the cost of production here in the states seem to vary widely. Over time technology will likely bring the costs down but for some we may have already crossed the line of profitability putting stock prices and jobs at risk.

Just how far crude could fall has been Wall Street’s favorite pass time. OPEC’s announcement of course came on an American Holiday with many traders AWOL and a shortened session Friday for investor reaction. Given the price action we saw Thursday trading in energy stocks is going to be frantic early on. How they close will be a lot more important than how they open. Maybe then we can pick through the rubble looking for something more than a falling knife.

avi8chauhan liked this

financecontributors-blog liked this

financecontributors-blog reblogged this from davidnelsoncfa

davidnelsoncfa posted this